Sound Bite

Is the dollar losing its luster as the world's reserve currency, and is deficit spending really a crime? Author Lew Kaplan doesn't think so. What's more, Kaplan points to the urgent need to outperform Communist Russia as the stimulus that drove the United States to develop so aggressively and successfully in the 20th century.

The authorÃ?ÃÂ traces 20th century history and argues that US prosperity is inexorably linked to the US deficit and that any movement toward reducing the deficit will negatively impact the domestic and global economy; and (2) credits Stalin's missteps and the onset of the Cold War for the economic impetus that made the US economy such an outstanding powerhouse.

About the Author

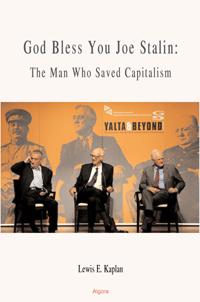

Lewis E. Kaplan’s 40 years of publishing and business experience have provided him with first-hand knowledge of the impact of currency exchange fluctuations on the domestic market, and the role of the U.S. dollar in the global economy. His first book was God Bless You, Joe Stalin: — The Man Who Saved Capitalism (Algora 2006).This is followed by The Making of the American Dream - An Unconventional History, a work in two volumes.

A lifelong student of history, he attended Cornell University and completed his studies at the University of Aix-en-Provence. During World War II, he served in the Army Air Force in the Pacific. Kaplan was founder of RetailWeek, an award-winning business publication, vice-president of marketing for GENESCO Europa, and president of PLADS, a division of Kellwood Company. He served as a consultant to Fortune 500 corporations.

|

|

About the Book

Stalin has been accused of many things; add to the list his role as the father of modern-day economics.

The dramatic narrative traces the evolution of the concept of the Almighty Dollar against the backdrop of the development and...

Stalin has been accused of many things; add to the list his role as the father of modern-day economics.

The dramatic narrative traces the evolution of the concept of the Almighty Dollar against the backdrop of the development and denouement of the Cold War, demonstrating how individual decisions made by US and Soviet leaders affected the course of events.

This enlightening and controversial book sets forth the thesis that the growing prosperity of the U.S. during the past 60 years is directly linked to deficit spending, and that the synergy of these two phenomena will continue for the foreseeable future.

An analysis of the Historical Tables of the United States Government, showing the tandem growth of U.S. deficits and the GDP, is interwoven into the historical recounting. In July 2008, "John Lipsky, first deputy manager of the [IMF] said the fund did not think there was a serious risk of the dollar losing its reserve currency role. 'Notwithstanding the dramatic claims by some, there is no doubt that the dollar will retain the central role,' he said." (Financial Times, July 23, 2008, page 1).

The epilogue concludes that the U.S. economy is on a treadmill of deficit spending, and that if deficit spending is substantially reduced, a global recession will ensue.

Furthermore, The Almighty Dollar is not in danger of collapse because if the nations of the world don't sustain the integrity of the U.S. dollar as the currency of exchange, their own economies will collapse.

|

Introduction Chapter 1. Evolution of the Almighty Dollar Chapter 2. The Amazing American Economy Chapter 3. Beyond Good and Evil: A Different Portrait of Joe Stalin Chapter 4. The Cont

Introduction Chapter 1. Evolution of the Almighty Dollar Chapter 2. The Amazing American Economy Chapter 3. Beyond Good and Evil: A Different Portrait of Joe Stalin Chapter 4. The Contradictions of State Socialism Chapter 5. The Cold War Begins: The Truman Presidency Chapter 6. The Cold War in Neutral: The Eisenhower Presidency Chapter 7. Expanding the Cold War: The Kennedy Presidency Chapter 8. The Great Society: The Johnson Presidency Chapter 9. The Renegade Republican: The Nixon Presidency Chapter 10. Frustration: The Presidencies of Ford and Carter Chapter 11. America on the Attack: The Reagan Presidency Chapter 12. The End of the Cold War: The George H. W. Bush Presidency Appendix: Tables

|

More Information

"John Lipsky, first deputy manager of the [IMF] said the fund did not think there was a serious risk of the dollar losing its reserver currency role. 'Notwithstanding the dramatic claims by some, there is no doubt that the dollar will retain the central role,' he said." -- Financial Times, July 23, 2008, page 1.

"John Lipsky, first deputy manager of the [IMF] said the fund did not think there was a serious risk of the dollar losing its reserver currency role. 'Notwithstanding the dramatic claims by some, there is no doubt that the dollar will retain the central role,' he said." -- Financial Times, July 23, 2008, page 1.

|

Book News

This work argues that it was the rivalries of the Cold War that led to prosperity and growth in the United States, linking the rise of the dollar%u2019s role as the world%u2019s de facto reserve currency to US Cold War deficit

spending. The author supports his arguments by tracing the Cold War policies of American presidents and links them to economic policy. He also spends some time criticizing the economic policies of the Soviet

Union.

|

|

Pages 324

Year: 2006

LC Classification: D843.K336

Dewey code: 940.55--dc22

BISAC: HIS037070

BISAC: BUS023000

Soft Cover

ISBN: 978-0-87586-464-8

Price: USD 23.95

Hard Cover

ISBN: 978-0-87586-465-5

Price: USD 32.95

eBook

ISBN: 978-0-87586-466-2

Price: USD 23.95

|